Shopify Capital Loan Tips for Small Business Owners sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The guide delves into the intricacies of securing a Shopify Capital Loan, providing valuable insights for small business owners looking to elevate their financial strategies.

As we explore the various aspects of Shopify Capital Loan Tips for Small Business Owners, readers will uncover essential information on eligibility criteria, application processes, loan management, and maximizing the benefits of this funding option.

Overview of Shopify Capital Loan

Shopify Capital Loan provides small business owners with a quick and convenient way to access funding to grow their business. This financing option is tailored specifically for merchants on the Shopify platform, making it easier for them to secure the capital they need.

Eligibility Criteria for Small Business Owners

- Active Shopify store: To be eligible for a Shopify Capital Loan, you must have an active Shopify store that meets certain criteria such as sales performance and history.

- Sales history: Shopify looks at your sales history on the platform to determine your eligibility for a loan. A strong sales track record can increase your chances of approval.

- Business location: Shopify Capital Loans are currently available in select countries, so make sure your business is located in a supported region.

Benefits of Choosing Shopify Capital Loan

- Fast approval process: Shopify Capital offers a streamlined application process with quick approval, allowing you to access funds promptly.

- No fixed monthly payments: Unlike traditional loans, Shopify Capital Loan repayment is based on a percentage of your daily sales, making it more flexible for small businesses.

- No personal guarantee: You won't need to provide a personal guarantee or put up collateral to secure a Shopify Capital Loan, reducing personal risk.

How to Apply for a Shopify Capital Loan

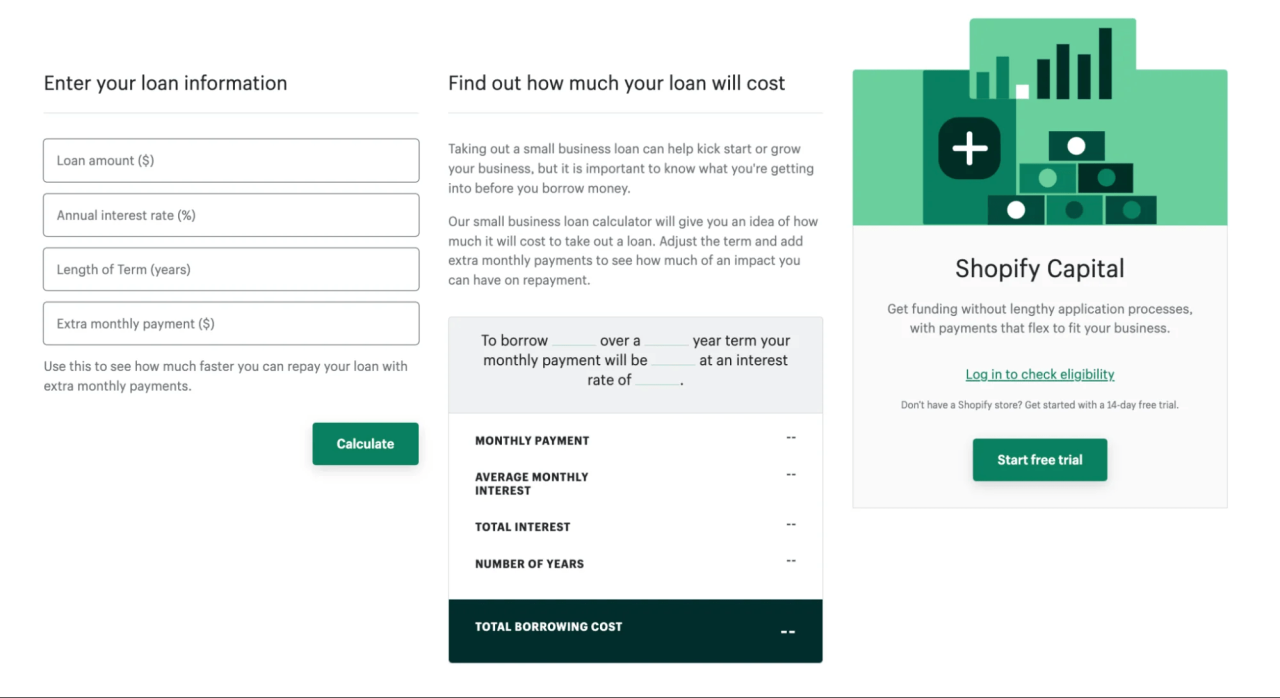

Applying for a Shopify Capital Loan is a straightforward process that can provide your small business with the funding it needs to grow and succeed. Here is a step-by-step guide on how to apply for a Shopify Capital Loan, along with tips on preparing the necessary documents and understanding the typical time frame for approval and disbursement of funds.

Application Process

- Create a Shopify account: Before applying for a Shopify Capital Loan, make sure you have a Shopify account set up for your business.

- Check your eligibility: Review the eligibility criteria for Shopify Capital Loans to ensure your business meets the requirements.

- Access the capital tab: Log in to your Shopify account and navigate to the capital tab to begin the application process.

- Complete the application: Fill out the application form with accurate information about your business, including financial details and the amount of funding you require.

- Submit documents: Upload any required documents, such as bank statements or financial records, to support your application.

Preparing Necessary Documents

- Business financial statements: Have your business financial statements ready to provide a clear picture of your company's financial health.

- Bank statements: Prepare recent bank statements to show your business's cash flow and financial stability.

- Tax returns: Gather past tax returns to demonstrate your business's income and tax compliance.

- Business plan: Create or update your business plan to Artikel how you will use the funds from the Shopify Capital Loan.

Approval and Disbursement Time Frame

- Approval process: Once you submit your application and documents, Shopify will review your information and make a decision on your loan application.

- Typical time frame: The approval process for a Shopify Capital Loan can vary, but you can expect a decision within a few days to a week.

- Disbursement of funds: If approved, funds are typically disbursed directly to your business bank account within a few business days.

Managing Loan Repayments

Managing loan repayments effectively is crucial for the financial health of your small business. Failure to meet repayment deadlines can lead to severe consequences, impacting your credit score and overall business operations. Here are some strategies to help you navigate the repayment process and avoid any pitfalls:

Set up a Repayment Schedule

- Establish a clear repayment schedule that aligns with your business's cash flow.

- Automate payments to ensure timely and consistent repayments.

- Monitor your finances regularly to track your progress and make adjustments if needed.

Prioritize Loan Repayments

- Make loan repayments a top priority to avoid accumulating additional interest or fees.

- Consider allocating a portion of your revenue specifically for loan repayments.

- Avoid taking on additional debt while you are still repaying your Shopify Capital Loan.

Communicate with Shopify

- If you anticipate difficulty in making a repayment, reach out to Shopify Capital to discuss possible solutions.

- They may offer flexibility or alternative arrangements to help you manage repayments during challenging times.

- Ignoring the issue will only exacerbate the situation, so open communication is key.

Consequences of Missing Repayments

- Missing repayments can result in late fees, penalties, and damage to your credit score.

- Defaulting on your loan can lead to legal action and even the seizure of your assets.

- It's essential to prioritize loan repayments to avoid these negative repercussions.

Impact on Cash Flow

- Loan repayments can affect your business's cash flow, especially if they are not properly managed.

- Consider the timing of repayments in relation to your revenue cycles to minimize cash flow disruptions.

- Maintaining a healthy cash flow is crucial for the sustainability and growth of your small business.

Maximizing the Benefits of Shopify Capital Loan

Small business owners can leverage a Shopify Capital Loan to propel the growth of their business to new heights. By utilizing the funds strategically, businesses can expand their operations, increase inventory, invest in marketing, or even improve their online presence.

Having a Clear Plan for Fund Utilization

It is crucial for business owners to have a well-defined plan for how they will use the funds from the Shopify Capital Loan. Whether it's for launching a new product line, upgrading equipment, or expanding into new markets, having a clear roadmap will ensure that the funds are put to the best possible use.

Success Stories of Businesses Benefiting from Shopify Capital Loan

- One success story involves a small boutique that used the loan to revamp their website, implement a targeted marketing campaign, and expand their product offerings. This resulted in a significant increase in online sales and customer engagement.

- Another business used the loan to invest in new technology that streamlined their manufacturing process, leading to increased productivity and cost savings.

- A startup utilized the funds to scale their operations and hire additional staff, allowing them to meet growing demand and establish a stronger presence in the market.

End of Discussion

In conclusion, Shopify Capital Loan Tips for Small Business Owners serves as a beacon of knowledge and guidance for entrepreneurs navigating the financial landscape. By following the tips and strategies Artikeld in this guide, small business owners can make informed decisions to propel their ventures to new heights.

General Inquiries

What are the eligibility criteria for a Shopify Capital Loan?

Small business owners need to have an active Shopify account and meet certain sales thresholds to qualify for a Shopify Capital Loan.

How long does it take to get approved for a Shopify Capital Loan?

The approval process for a Shopify Capital Loan typically takes a few business days, depending on the completeness of the application.

What happens if I miss a repayment on my Shopify Capital Loan?

Missing a repayment can lead to additional fees and impact your credit score. It's crucial to communicate with Shopify Capital to discuss alternative arrangements if needed.

Can I use a Shopify Capital Loan for any business expenses?

While Shopify Capital Loans are flexible, it's advisable to use the funds for business growth initiatives to maximize the benefits.