Delving into Shopify Capital Loans: Are They Worth It for Growth?, this introduction immerses readers in a unique and compelling narrative that explores the benefits and considerations of utilizing these loans for business expansion.

The second paragraph provides detailed information on what Shopify Capital Loans entail and how they can impact business growth positively.

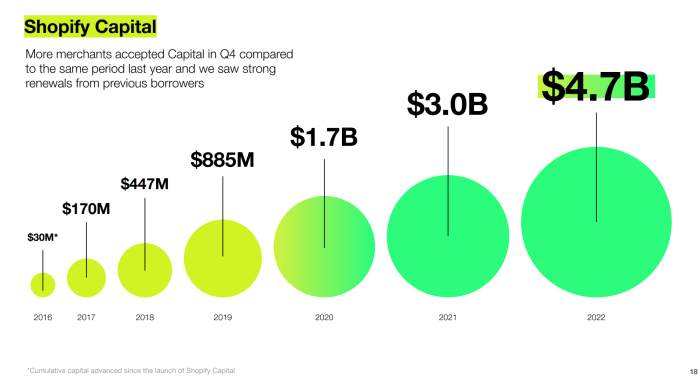

Overview of Shopify Capital Loans

Shopify Capital Loans are a financing option provided by Shopify to eligible merchants on their platform. These loans are designed to help businesses grow and expand their operations by providing access to capital quickly and easily.

How Shopify Capital Loans Work

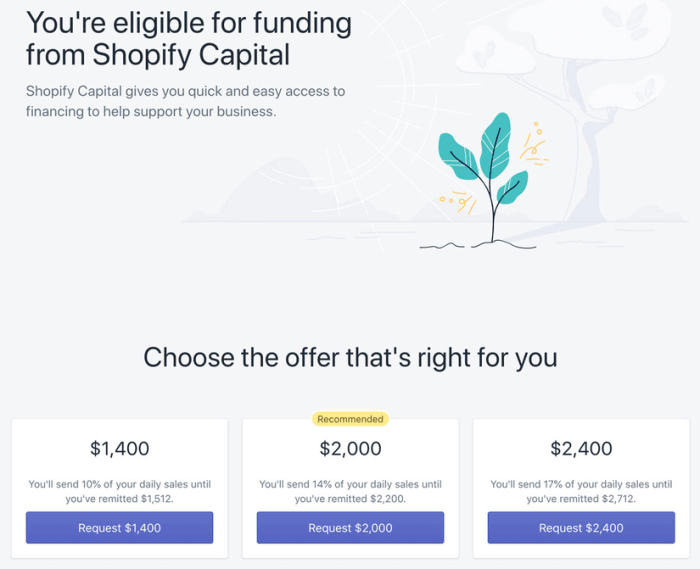

Shopify Capital Loans work by offering a lump sum of money to eligible businesses, which is then repaid through a percentage of their daily sales on the platform. The repayment amount fluctuates based on the business's sales, making it a flexible and convenient option for merchants.

Examples of Businesses that Can Benefit

- E-commerce stores looking to increase inventory

- Businesses wanting to launch new marketing campaigns

- Retailers seeking to expand their physical locations

Eligibility Criteria for Shopify Capital Loans

- Must be a registered business on the Shopify platform

- Have a minimum threshold of sales on the platform

- Good payment history and consistent sales performance

Pros and Cons of Shopify Capital Loans

When considering Shopify Capital Loans for business growth, it is essential to weigh the advantages and disadvantages to make an informed decision.

Advantages of Shopify Capital Loans:

- Quick and Easy Application Process: Shopify Capital Loans offer a streamlined application process compared to traditional bank loans, saving time and effort for business owners.

- No Fixed Monthly Payments: Unlike traditional bank loans, Shopify Capital Loans are repaid based on a percentage of daily sales, providing flexibility during slower sales periods.

- No Credit Check: Shopify Capital Loans do not require a credit check, making them accessible to businesses with less-than-perfect credit scores.

- Funding for Growth: The funds from Shopify Capital Loans can be used for various business purposes, such as inventory restocking, marketing campaigns, or expansion projects.

Drawbacks of Shopify Capital Loans:

- Higher Fees: Shopify Capital Loans may come with higher fees compared to traditional bank loans, impacting the overall cost of borrowing.

- Limitation on Loan Amounts: Shopify Capital Loans typically offer smaller loan amounts compared to traditional bank loans, which may not meet the financial needs of larger businesses.

- Automatic Repayments: The automatic daily repayments of Shopify Capital Loans can affect cash flow management, especially during slower sales periods.

Comparison with Traditional Bank Loans:

When comparing Shopify Capital Loans with traditional bank loans, it is evident that each option has its own set of advantages and limitations.

| Criteria | Shopify Capital Loans | Traditional Bank Loans |

|---|---|---|

| Application Process | Quick and streamlined | More paperwork and longer processing times |

| Repayment Structure | Based on daily sales percentage | Fixed monthly payments |

| Accessibility | No credit check required | Credit check and collateral may be necessary |

| Loan Amount | Smaller amounts | Potentially higher loan amounts |

Application Process and Requirements

When it comes to applying for a Shopify Capital Loan, there are specific steps and requirements you need to be aware of to increase your chances of approval and secure the funding you need for your business.

Application Steps

- Log in to your Shopify account and check if you're eligible for a loan offer.

- Review the loan offer details, including the amount, fees, and repayment terms.

- If you decide to accept the offer, complete the application by providing the necessary information.

- Wait for Shopify's review and approval process, which typically takes a few days.

- If approved, the funds will be deposited into your business account for immediate use.

Documentation and Information

- Basic business information, such as your company's name, address, and contact details.

- Financial documents, including bank statements, tax returns, and sales history from your Shopify store.

- A business plan outlining how you intend to use the loan and how it will benefit your business.

- Personal identification, such as a driver's license or passport, to verify your identity.

Tips for Approval

- Ensure your Shopify store has a strong sales history and positive customer reviews to demonstrate your business's success.

- Provide accurate and detailed financial information to show your ability to repay the loan.

- Prepare a compelling business plan that highlights your growth opportunities and the impact of the loan on your operations.

- Maintain a good credit score and address any outstanding debts or issues that could affect your creditworthiness.

Interest Rates and Repayment Terms

When considering Shopify Capital Loans for business growth, understanding the interest rates and repayment terms is crucial. This information can help businesses make informed decisions about taking on debt to fuel their expansion.

Typical Interest Rates

- Shopify Capital Loans typically offer fixed fees instead of traditional interest rates. These fees are determined upfront based on the amount borrowed and are deducted from future sales.

- The fixed fees can range anywhere from 10% to 30% of the borrowed amount.

- Since there are no compounding interest rates, businesses have a clear understanding of the total repayment amount from the start.

Repayment Terms and Options

- Repayment terms for Shopify Capital Loans are flexible, as the fixed fees are automatically deducted from daily sales made through the Shopify platform.

- There is no set repayment schedule, and the amount deducted depends on the daily sales volume of the business.

- This structure allows businesses to repay the loan at a pace that aligns with their cash flow, making it less burdensome compared to traditional loans with fixed monthly payments.

Scenarios for Interest Rates and Repayment Terms

- Favorable Scenario:A business experiences a sudden surge in sales after taking a Shopify Capital Loan. Since the repayment is tied to daily sales, the loan can be repaid quickly without additional fees, resulting in a cost-effective financing option.

- Challenging Scenario:If a business faces a slowdown in sales or seasonal fluctuations, the fixed fees deducted from daily sales may impact cash flow. In such cases, businesses may find it challenging to meet other financial obligations while repaying the loan.

Conclusion

In conclusion, Shopify Capital Loans offer a valuable funding option for businesses looking to grow, but careful consideration of the pros and cons is essential to make an informed decision.

Quick FAQs

What are the eligibility criteria for applying for a Shopify Capital Loan?

The eligibility criteria typically include factors such as revenue history and sales volume on the Shopify platform.

What are the typical interest rates for Shopify Capital Loans?

Interest rates for Shopify Capital Loans can vary but are generally competitive compared to traditional bank loans.

How can businesses improve their chances of approval for a loan from Shopify Capital?

Businesses can enhance their approval chances by maintaining a strong sales record and demonstrating a reliable revenue stream.